Laser-focused on market-neutral and delta-neutral strategies in crypto markets

DELTA ZERO

Trading

Marvel Capital is a quantitative digital asset manager established in 2021, focused on generating superior risk-adjusted returns. We employ statistical and mathematical models from traditional financial markets to create market-neutral trading strategies to produce uncorrelated returns.

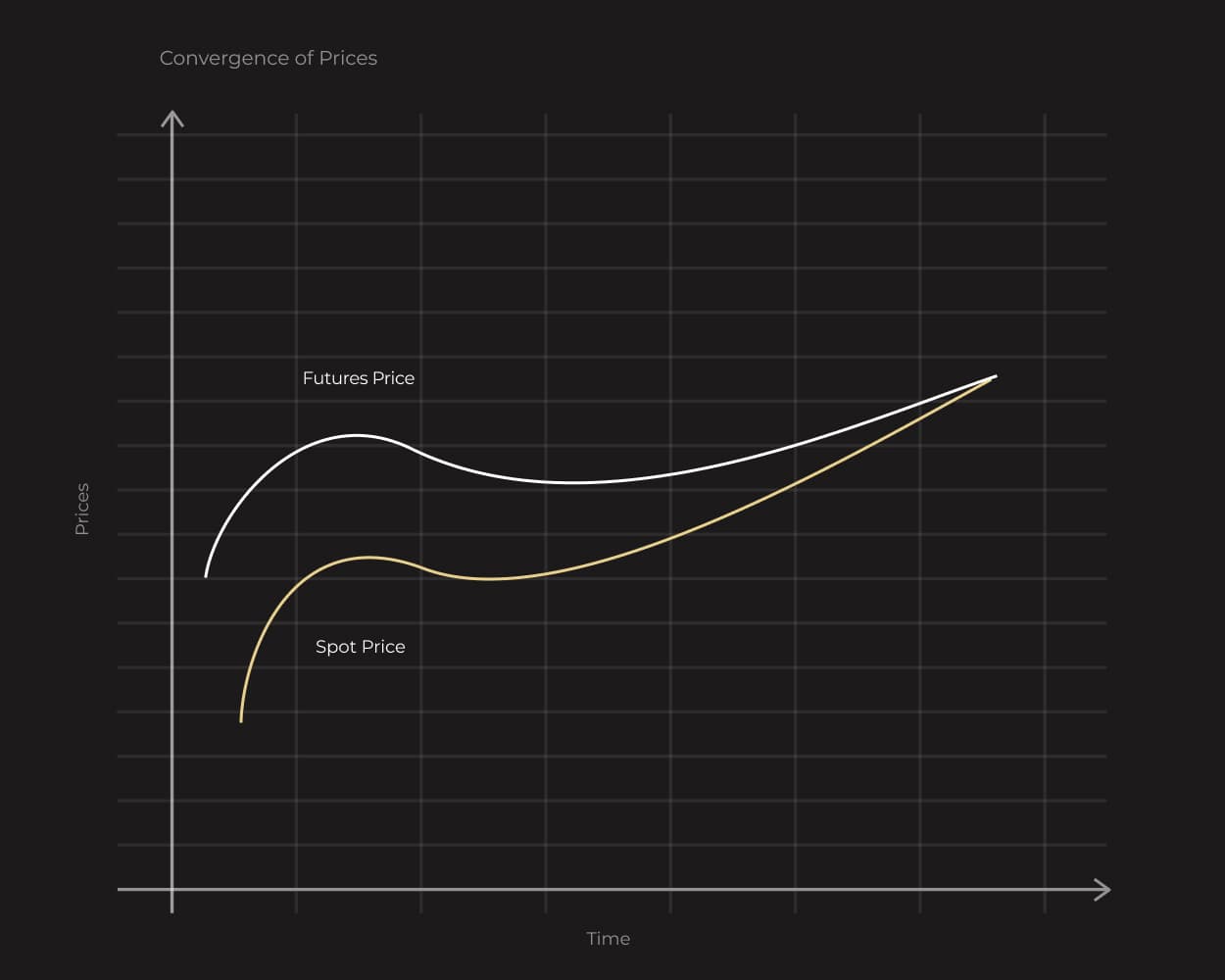

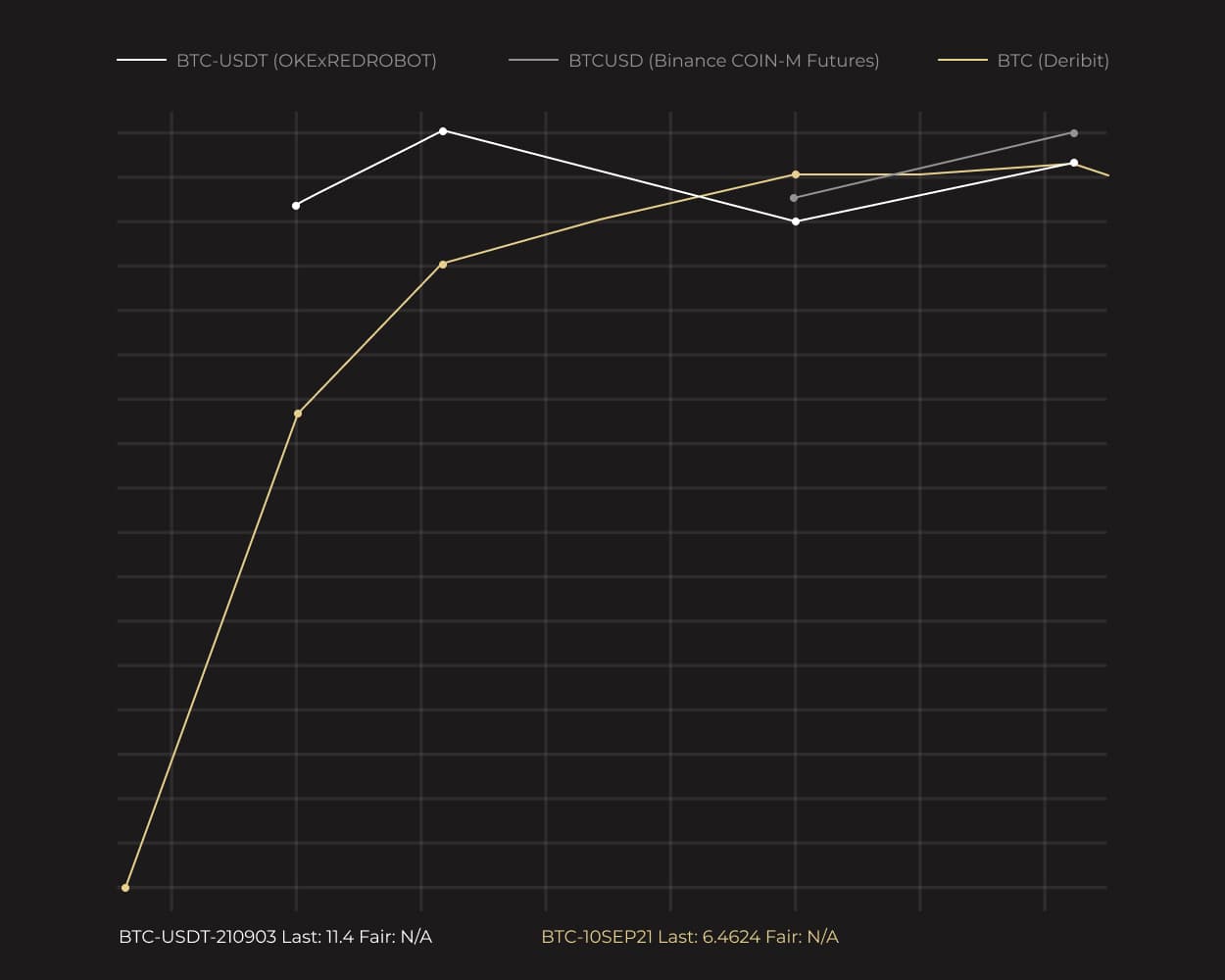

We exploit intertemporal and geographic price differentials in the most established cryptocurrencies to generate returns regardless of the directional movement of the market itself. The team has taken the basic trading principles of equity arbitrage learned over years of experience and adapted them to the emerging cryptocurrency universe.

We engage in market-neutral strategies with no residual exposure. The strategies include trading spot listings across exchanges in order to benefit from price discrepancies, as well as monetizing price differentials by trading spot against dated futures and swaps. Trading is executed through fast and secure automated systems, driven by bespoke proprietary algorithmic software.

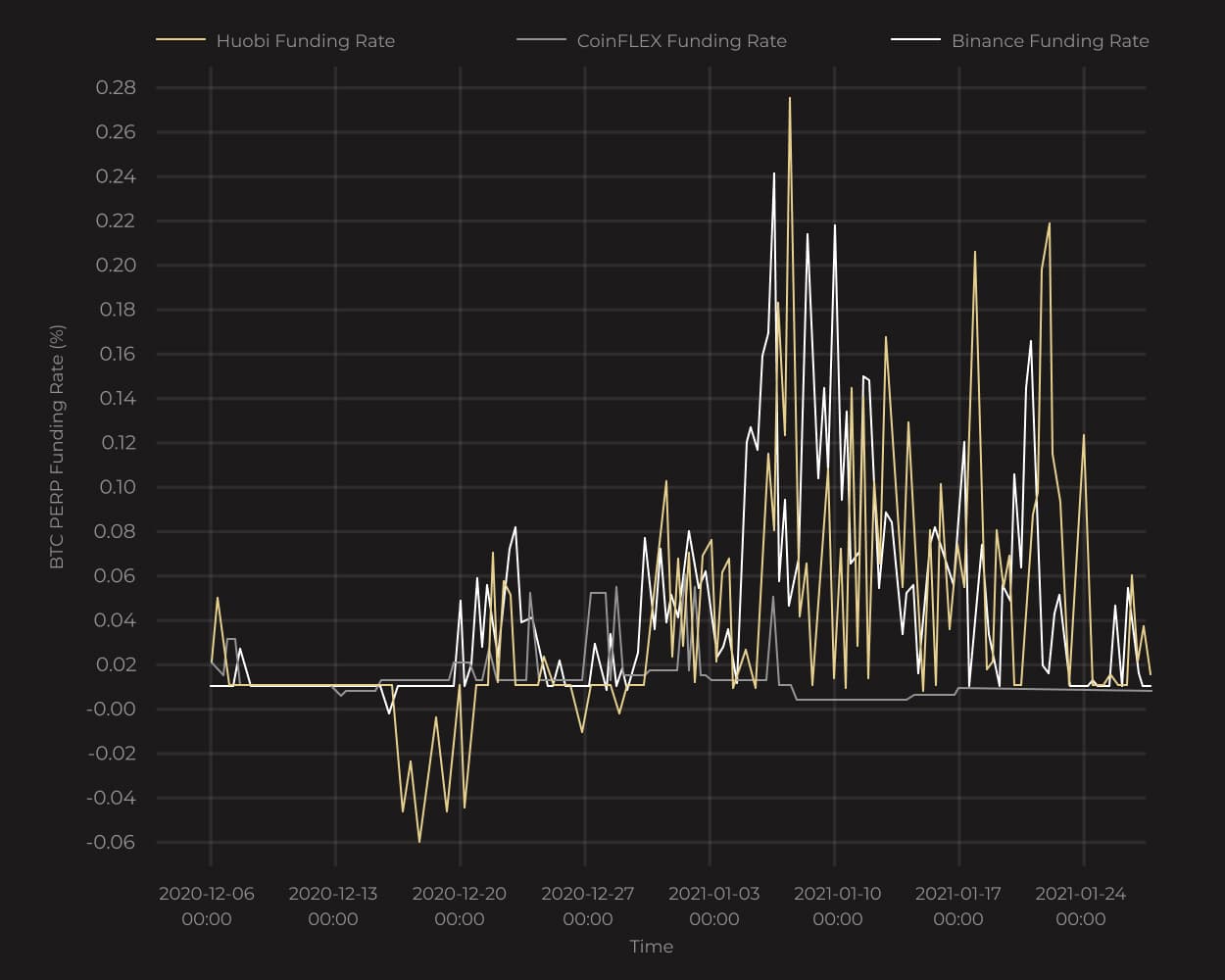

Volatility is good!

Over the past 10 years, digital assets have proven more volatile than any other major asset class, creating ideal conditions for systematic quantitative trading.

Mission

Marvel Capital strives to generate superior returns by providing delta-neutral exposure to cryptocurrency markets